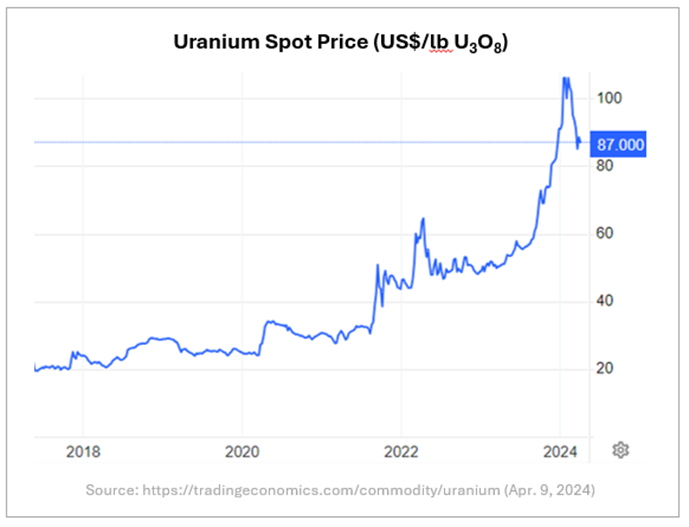

- Uranium prices hit 16-year high in February 2024

- America has $4.3B plan to buy uranium from domestic producers

- Labrador’s Central Mineral Belt among top uranium exploration regions in Canada

Vancouver, British Columbia, May 15, 2024 (GLOBE NEWSWIRE) — MegaWatt Lithium and Battery Metals Corp. (CSE:MEGA) (FSE: WR20) (OTCQB: WALRF) (the “Company“, “MegaWatt Metals” or “MegaWatt”) is pleased to provide an update on long-term uranium sector drivers, America’s plan to source domestic uranium for its expanding nuclear power generation, and Canada’s leading role in uranium exploration and mining. The world generates roughly 10% of its power from nuclear energy,[1] with America generating about 20% of its total electricity from nuclear while producing more nuclear power than any other nation.[2] To reach current global decarbonization targets, however, the International Energy Agency (IEA) projects that worldwide nuclear power production needs to increase by 80% by 2040.[3] Fortunately, the US and 20 other countries plan to triple their nuclear power capacity by 2050.[4]

MegaWatt Metal’s CEO, Casey Forward, commented: “With long-term investment in nuclear power increasing, and uranium prices hitting a 16-year high in February, our announcement on April 1, 2024 of entering an agreement to acquire Labrador Mineral Resources Inc. and their Canada-based Benedict Mountains Uranium Property in Labrador’s Central Mineral Belt is timely and marks a significant milestone in advancing MegaWatt’s commitment to becoming a domestic, clean-energy minerals supplier.”

Please click here to view image

The number of countries turning to nuclear to provide low-carbon energy continues to grow. As a result, total global nuclear power generation is expected to break records in 2025, with China, India, Korea and Europe expected to have new reactors come online, while several reactors in Japan are forecast to return to generation, and French output is expected to increase.[5]

As the world’s largest producer of nuclear power, the US accounts for about 30% of global nuclear energy generation and currently has 94 operable nuclear reactors.[6] At the same time, America is committed to advancing its strengths in the nuclear energy sector.

The US has earmarked $6 billion to maintain existing nuclear reactors, has dedicated $2.5 billion for R&D into new nuclear technologies,[7] and has a $4.3-billion-dollar plan to buy uranium from domestic producers to wean the country off its reliance on Russian imports.[8] Meanwhile, America’s Inflation Reduction Act (IRA) includes various tax credits and incentives for clean energy technologies and $700 million to support establishing a domestic-based uranium supply chain.[9]

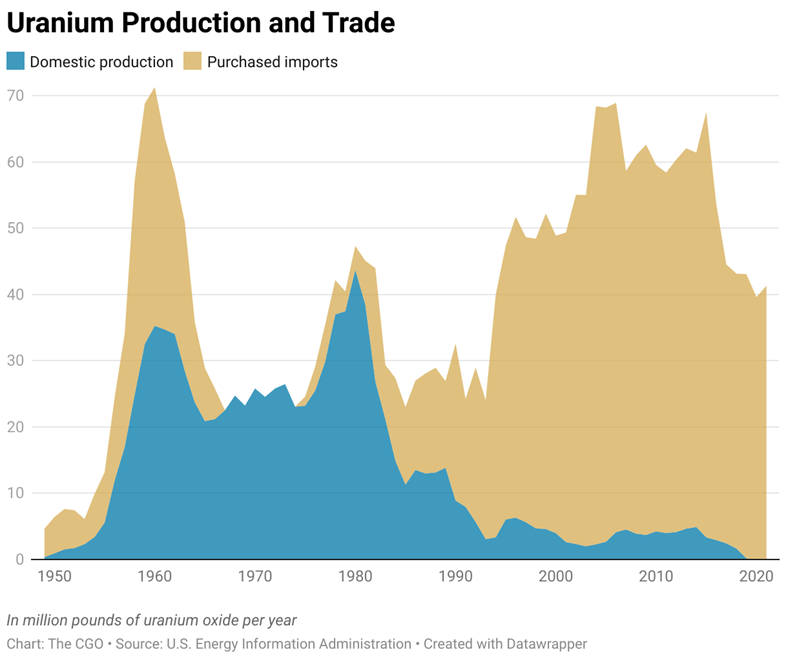

America’s push to develop a more reliable domestic uranium supply chain is understandable due to the country producing only 5% of the uranium it uses annually as fuel. As such, the nation is heavily reliant on imports, with the top supplying countries being Kazakhstan (35%), Canada (15%), Australia (14%), Russia (14%) and Namibia (7%).[10]

Adding to America’s urgency for uranium supply security is the country’s declining rate of domestic uranium production since the early 1980s[11] and market analysts projecting an average global uranium supply deficit of 35 million pounds per year over the coming decade.[12]

Please click here to view image

Against this backdrop of upward-trending uranium prices, growing demand, and America’s need for secure domestic supplies, Canada-based explorers and producers are uniquely positioned to benefit:

- Canada was the world’s largest uranium producer for many years, accounting for about 22% of global output, until overtaken in 2009 by Kazakhstan;

- most of Canada’s uranium resources are in high-grade deposits, with some being 100X the world average;

- in 2022, Canada’s Federal Government introduced a 30% critical mineral exploration tax credit to support specified exploration expenditures, applicable to uranium exploration;

- and over 85% of the nation’s uranium production is exported.[13]

Uranium exploration in Canada is mainly focused on Saskatchewan’s Athabasca Basin and Labrador’s Central Mineral Belt.

Labrador’s Central Mineral Belt is a major under-developed mineral jurisdiction that contains the Michelin deposit, one of largest uranium deposits in North America. Michelin contains a total Mineral Resource of 92 million pounds (Mlb) uranium, with 82.2Mlb being in the Measured and Indicated Mineral Resources category.[14] Other significant uranium deposits in the Central Mineral Belt include Moran Lake C Zone, Inda, Nash, Gear, Kitts, and the more recently discovered Jacques Lake, Two Time Zone, Anna Lake, White Bear Lake, and Rainbow deposits.[15]

As announced in the Company’s news release of May 7, 2024, titled “MegaWatt Completes the Acquisition of Labrador Mineral Resources Inc.”, MegaWatt Metals has acquired Labrador Mineral Resources Inc. and their Benedict Mountains Uranium Property, which consists of 2 mineral licenses covering an area of approximately 350 hectares in Labrador’s Central Mineral Belt. The Benedict Mountains Uranium Property represents a new level of opportunity for MegaWatt to benefit from the long-term drivers supporting the uranium sector while advancing the Company’s focus on becoming a domestic, clean-energy minerals supplier.

For Additional Information

Investors can learn more about the Company, our team and latest news at https://megawattmetals.com.

About MegaWatt Lithium and Battery Metals Corp.

MegaWatt is a British Columbia based company involved in the acquisition and exploration of mineral properties.

MegaWatt has acquired a 100% interest in a company that holds a 100% interest (subject to a 1.5% NSR) in the Benedict Mountains Uranium Property, consisting of 2 mineral licenses covering an area of approximately 350 hectares in the Central Mineral Belt on the east coast of Labrador, Canada, approximately 200 km NE of Goose Bay (see press release dated April 1, 2024).

MegaWatt holds a 100% undivided interest (subject to a 1.5% NSR) on all base, rare earth elements and precious metals, in the Cobalt Hill Property, consisting of 8 mineral claims covering an area of approximately 1,727.43 hectares located in the Trail Creek Mining Division in the Province of British Columbia, Canada.

Additionally, the Company has acquired a 100% interest in a company that indirectly holds a 100% interest (subject to a 2% NSR) in the Tyr Silver Project (see press release dated October 15, 2020).

MegaWatt holds a 100% interest (subject to a 2% NSR) in and to the Route 381 Lithium Property, comprised of 40 mineral claims located in James Bay Territory, north of Matagami in the Province of Quebec, covering 2,126 hectares (see press release dated February 3, 2021), and a 100% interest in 229 additional mineral exploration claims prospective for lithium, also in the James Bay area of Quebec covering an area of 12,116 hectares or 121 square kms.

On Behalf of the Board of Directors,

MegaWatt Lithium and Battery Metals Corp.

Casey Forward, CEO

1055 West Georgia Street, Suite 1500

Vancouver, BC, Canada

V7X 1M5

For Further Information Please Contact:

Kelvin Lee, Chief Financial Officer

[email protected], (236) 521-6500

SOURCES:

1. https://sprott.com/media/4382/nuclear-energy-carbon-free-future-white-paper.pdf

2. https://www.eia.gov/energyexplained/nuclear/nuclear-power-plants.php

3. https://www.iea.org/reports/nuclear-power-in-a-clean-energy-system

4. https://tradingeconomics.com/commodity/uranium

5. https://www.theguardian.com/environment/2024/jan/24/nuclear-power-output-expected-to-break-global-records-in-2025

6. https://world-nuclear.org/information-library/country-profiles/countries-t-z/usa-nuclear-power.aspx

7. https://www.nytimes.com/2022/07/05/business/energy-environment/nuclear-energy-politics.html

8. https://www.bloomberg.com/news/articles/2022-06-07/us-seeks-4-3-billion-for-nuclear-fuel-to-wean-off-russia-supply

9. https://www.energy.gov/ne/articles/inflation-reduction-act-keeps-momentum-building-nuclear-power

10. https://www.eia.gov/energyexplained/nuclear/where-our-uranium-comes-from.php

11. https://www.thecgo.org/benchmark/establishing-secure-uranium-supply-chains-for-a-future-of-abundant-energy/

12. https://resourceworld.com/bullish-outlook-on-uranium-sector/

13. https://world-nuclear.org/information-library/country-profiles/countries-a-f/canada-uranium.aspx

14. https://www.paladinenergy.com.au/exploration/michelin-canada/

15. https://www.findnewfoundlandlabrador.com/files/2017/03/Uranium-in-Labrador-Jan-2012.pdf

The CSE does not accept responsibility for the adequacy or accuracy of this release.

This press release includes “forward-looking information” that is subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. These forward-looking statements or information may relate to the Company’s business plans, the exploration plans of the Company and the timing thereof, and other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

Bay Street News